Mark Warner

- VAVirginia

- Senior Senator

Mark Warner (D)

VirginiaSenior SenatorOffice:

703 Hart Senate Office Building Washington DC 20510

Memberships:

- Senate Committee on Banking, Housing, and Urban Affairs

- Senate Committee on Finance

- Senate Committee on Rules and Administration

- Senate Committee on the Budget

- Senate Select Committee on Intelligence

Terms:

- 2021 to 2027 - VA Senator

- 2015 to 2021 - VA Senator

- 2009 to 2015 - VA Senator

Add An Item To Mark Warner's Record

Mark Warner's Record on Bitcoin, Cryptocurrencies, and Blockchain

- 8/29/2025, 3:36:05 PM

Positive. +1

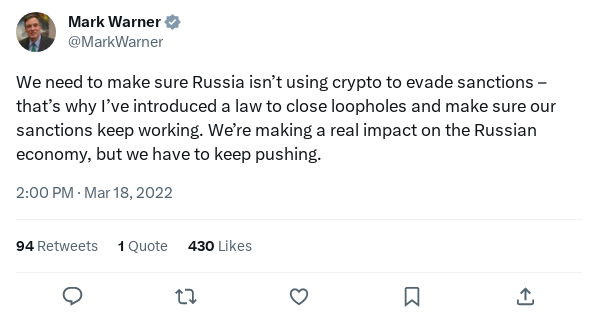

Senator Warner Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/18/2025, 6:06:57 PM

Positive. +1

June 17, 2025, 05:11 PM: Mark Warner voted FOR S. 1582 S. 1582 Title: A bill to provide for the regulation of payment stablecoins, and for other purposes.

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 5/20/2025, 8:33:47 PM

Positive. +1

May 19, 2025, 08:41 PM: Mark Warner voted FOR S. 1582 S. 1582 Title: A bill to provide for the regulation of payment stablecoins, and for other purposes.

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 5/9/2025, 5:44:38 PM

Negative. +1

May 8, 2025, 01:51 PM: Mark Warner voted AGAINST S. 1582 S. 1582 Title: A bill to provide for the regulation of payment stablecoins, and for other purposes.

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 3/12/2025, 7:10:31 PM

Positive. +1

March 4, 2025, 05:05 PM: Mark Warner voted FOR S.J.Res. 3 S.J.Res. 3 Title: A joint resolution providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Internal Revenue Service relating to "Gross Proceeds Reporting by Brokers That Regularly Provide Services Effectuating Digital Asset Sales".

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 5/16/2024, 9:33:24 PM

Negative. +1

May 16, 2024, 11:31 AM: Mark Warner voted AGAINST H.J.Res. 109 H.J.Res. 109 Title: A joint resolution providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Securities and Exchange Commission relating to "Staff Accounting Bulletin No. 121".

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 10/28/2023, 6:58:48 AM

Negative. +1

Senator Warner Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 7/19/2023, 5:08:35 PM

Negative. +1

The U.S. Senate is poised to take another crack at regulating the crypto industry with a new bill that would place stringent anti-money laundering (AML) requirements on decentralized finance (DeFi) protocols. DeFi protocols are financial applications that allow anyone with a crypto wallet to borrow, lend and trade cryptocurrency via smart contracts. They’re harder to regulate than, say centralized companies such as Coinbase, because they operate directly on permissionless blockchains. The bill envisions sidestepping these issues by placing requirements on “anyone who ‘controls’ a DeFi protocol or makes available an application to use the protocol,” likely a reference to groups who build user-friendly frontends for protocols’ otherwise cumbersome smart contracts, as Uniswap Labs does for Ethereum’s top decentralized exchange. “If nobody controls a DeFi protocol, then—as a backstop—anyone who invests more than $25 million in developing the protocol will be responsible for these obligations,” according to the briefing document. These controlling entities would need to vet and collect information on their customers, maintain anti money laundering programs, report suspicious activity to the government, and block sanctioned individuals from using their protocol. The bill would place identity verification requirements on crypto kiosks. It would also expand the Treasury Department’s authority to police alleged money launderers in non-traditional financial settings, including crypto. The bill was introduced Wednesday by Sen. Jack Reed (D-R.I.) a member of the Senate Banking Committee. Mike Rounds (R-S.D.), Mitt Romney (R-UT) and Mark Warner (D-VA) are co-sponsors.

Reference LinkSubmitted By: Anonymous - 6/23/2023, 9:36:38 PM

Negative. +1

Senator Warner Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 9:24:37 PM

Negative. +1

Senator Warner Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 9:23:29 PM

Positive. +1

Senator Warner Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 9:22:22 PM

Negative. +1

Senator Warner Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 8/29/2021, 5:16:58 PM

Positive. +1

Republican Sens. Pat Toomey (Pa.) and Cynthia Lummis (Wyo.) said an amendment to the infrastructure bill that would redefine who falls subject to cryptocurrency regulation requirements will be brought for a unanimous consent vote on Monday afternoon after a group of bipartisan senators and the Treasury Department came to an agreement. The amendment, which will be co-sponsored by Sens. Mark Warner (D-Va.), Rob Portman (R-Ohio) and Kyrsten Sinema (D-Ariz.), seeks to amend the definition of a “broker” in the underlying infrastructure bill in a way that would keep software developers and transaction validators from being subject to the new reporting requirements.

Reference LinkSubmitted By: Anonymous - 8/29/2021, 5:12:12 PM

Negative. +1

On Wednesday, Sens. Ron Wyden, D-Ore., Pat Toomey, R-Pa., and Cynthia Lummis, R-Wyo. introduced an amendment that drills down on the definition of a “broker,” explicitly excluding validators, hardware and software makers as well as protocol developers. It would be a win for the crypto caucus, should it pass. In the other camp sits Sens. Rob Portman, R-Ohio – who drafted the original tax provision – along with Mark Warner, D-Va. and Kyrsten Sinema, D-Ariz. They submitted their own rival amendment on Thursday. CNBC does not have a copy of the proposed Portman-Warner amendment. But based on prior revisions described by Portman, some believe it will leave the door open to a broader definition of “crypto broker” and will potentially subject more crypto investors to these higher taxes. ... Should the Portman camp win, Blockchain Association executive director Kristin Smith warns the ramifications will be sweeping and massively damaging to the country’s crypto industry.

Reference LinkSubmitted By: Anonymous