Ted Budd

- NCNorth Carolina

- Junior Senator

Ted Budd (R)

North CarolinaJunior SenatorOffice:

354 Russell Senate Office Building Washington DC 20510

Memberships:

- Joint Economic Committee

- Senate Committee on Armed Services

- Senate Committee on Commerce, Science, and Transportation

- Senate Committee on Small Business and Entrepreneurship

- Senate Select Committee on Intelligence

Terms:

- 2023 to 2029 - NC Senator

- 2021 to 2023 - NC District 13 Representative

- 2019 to 2021 - NC District 13 Representative

- 2017 to 2019 - NC District 13 Representative

Add An Item To Ted Budd's Record

Ted Budd's Record on Bitcoin, Cryptocurrencies, and Blockchain

- 6/24/2023, 2:23:20 AM

Positive. +1

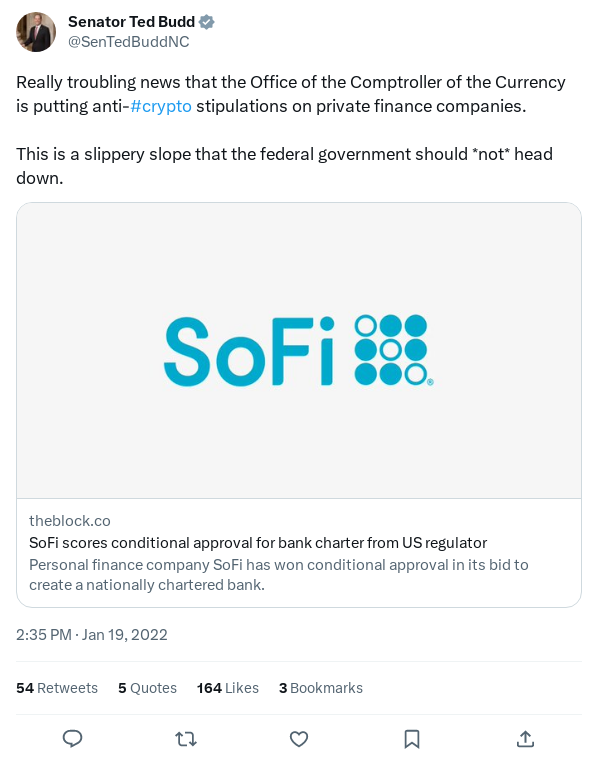

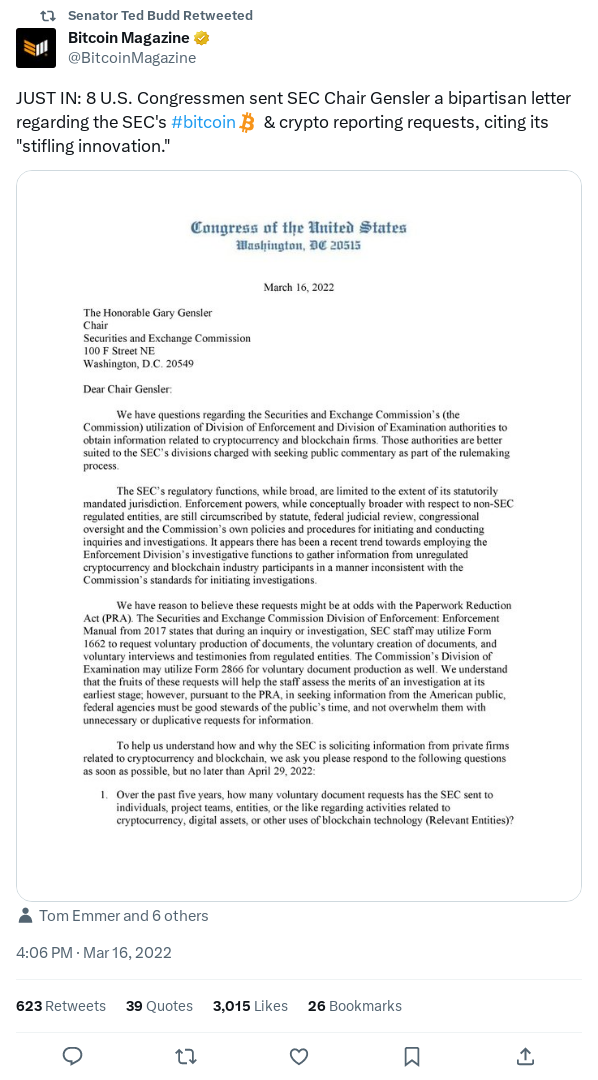

Senator Budd Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/24/2023, 2:22:13 AM

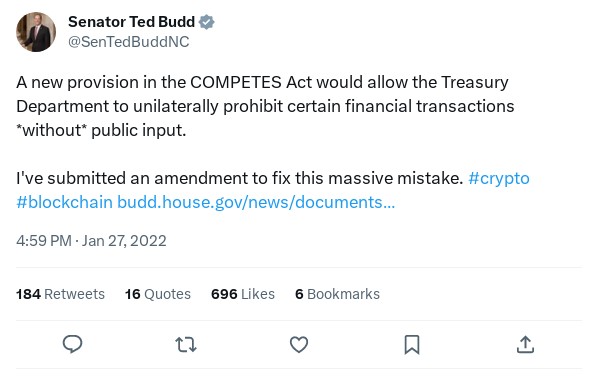

Positive. +1

Senator Budd Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/24/2023, 2:21:06 AM

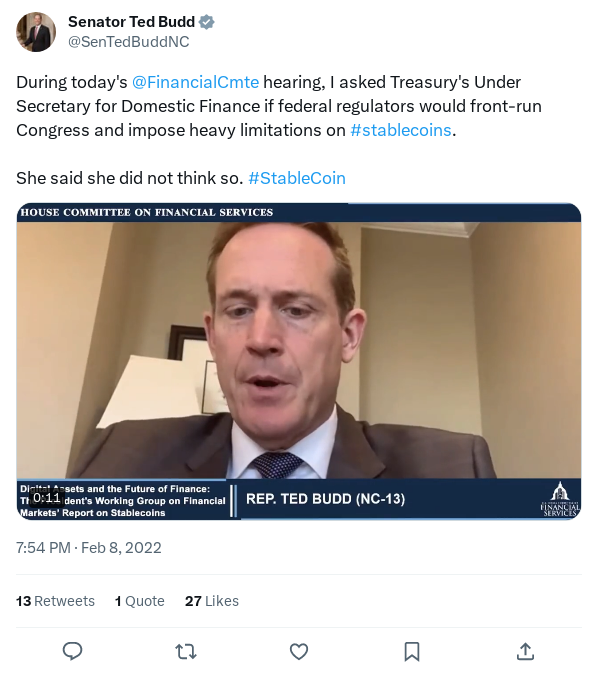

Positive. +1

Senator Budd Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/24/2023, 2:19:58 AM

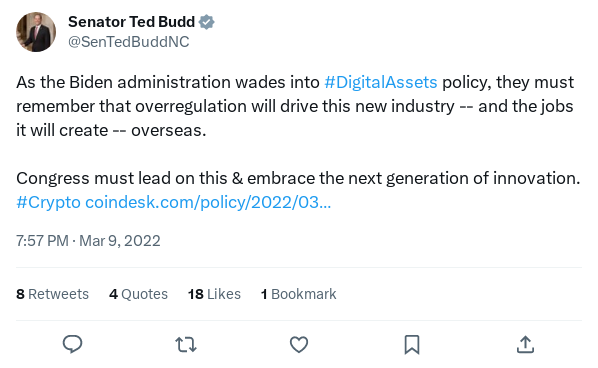

Positive. +1

Senator Budd Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/24/2023, 2:18:51 AM

Positive. +1

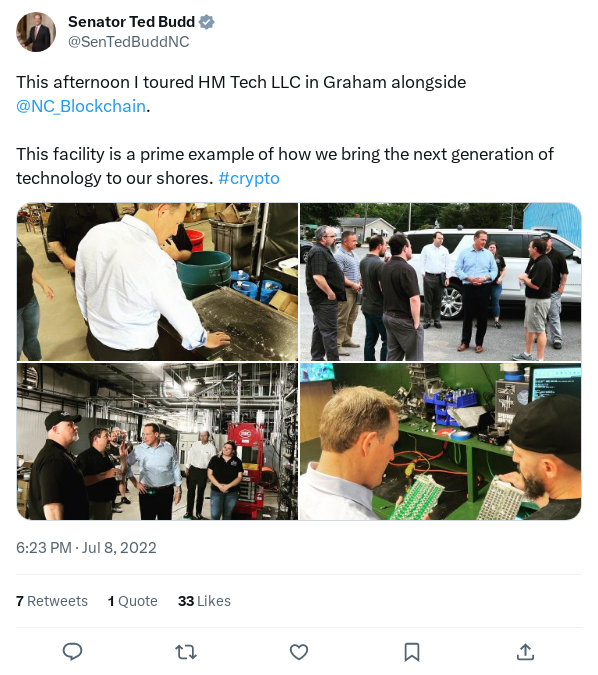

Senator Budd Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/24/2023, 2:17:44 AM

Positive. +1

Senator Budd Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/24/2023, 2:16:36 AM

Positive. +1

Senator Budd Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/24/2023, 2:15:29 AM

Positive. +1

Senator Budd Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/24/2023, 2:14:21 AM

Positive. +1

Senator Budd Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/24/2023, 2:13:14 AM

Positive. +1

Senator Budd Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/24/2023, 2:12:07 AM

Positive. +1

Senator Budd Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/24/2023, 2:10:59 AM

Positive. +1

Senator Budd Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 8/29/2021, 7:57:16 PM

Positive. +1

December 31, 2020 Washington, D.C. - Today, Congressman Tom Emmer (MN-06), Congressman Bill Foster (IL-11), Congressman David Schweikert (AZ-06), Congressman Darren Soto (FL-09), Congressman Warren Davidson (OH-08), Congresswoman Suzan K. DelBene (WA-01), Congressman Ted Budd (NC-13), Congress Woman Tulsi Gabbard (HI-02) and Senator Tom Cotton (AR) sent a letter to Treasury Secretary Steven Mnuchin to express concerns regarding a limited comment period to respond to a recently released rule making significant changes to the regulation of digital assets. The rule was announced on December 18, 2020, and comments must be received by January 4, 2021. The Financial Crimes Enforcement Network’s (FinCEN) rule would require certain members of the cryptocurrency industry to submit additional reports and keep records relating to customer identities if transactions are made above certain thresholds. The additional data collection also pertains to unhosted wallets, which do not require a financial institution to conduct transactions. “The blockchain industry and cryptocurrency innovations are constantly and rapidly evolving. Government frequently struggles to keep up. We owe it to this community to be fair, transparent, and open to stakeholder advice," said Emmer.

Reference LinkSubmitted By: Anonymous - 8/29/2021, 6:09:08 PM

Positive. +1

More than a dozen members of the House of Representatives sent a letter to Securities and Exchange Chairman Jay Clayton Friday urging his agency to tell investors, in plain English, how it plans to regulate cryptocurrency. “It is important that all policy makers work toward developing clearer guidelines between those digital tokens that are securities, and those that are not, through better articulation of SEC policy, and, ultimately, through formal guidance or legislation,” the letter said. The letter was an effort from both sides of the aisle, and was lead by Rep. Ted Budd, R-N.C., Reps. Emmer and Davidson, as well Darren Soto, D-Fla. In addition, David Schweikert, R-Ariz., Jeff Duncan, R- S.C., Alex Mooney, R- W.V., John Curtis, R-Utah, Ralph Norman, R- S.C., Andy Biggs, R-Ariz., Mark Meadows, R-N.C., Derek Kilmer, D-Wash., Greg Gianforte, R-Mont., and Sean Duffy, R-WI, were among the signatories.

Reference LinkSubmitted By: Anonymous - 8/29/2021, 4:21:33 PM

Positive. +1

Emmer Leads Bipartisan Blockchain Caucus Letter to the IRS Ahead of Tax Day Urging Virtual Currency Guidance: "Guidance is long overdue and essential to proper reporting of these emerging assets. The bipartisan support this letter has received should send a clear message to the IRS that clear guidelines for reporting virtual currency are necessary." Said Emmer, "My colleagues and I are optimistic that the IRS will issue the guidance needed for taxpayers struggling with these reporting requirements." Signers include Bill Foster (D-IL), David Schweikert (R-AZ), Darren Soto (D-FL), Patrick McHenry (R-NC), Jim McGovern (D-MA), French Hill (R-AR), Terri Sewell (D-AL), Warren Davidson (R-OH), Stephen Lynch (D-MA), Ted Budd (R-NC), Eric Swalwell (D-CA), Trey Hollingsworth (R-IN), Ed Perlmutter (D-CO), Greg Gianforte (R-MT), Josh Gottheimer (D-NJ), Mark Meadows (R-NC), Lance Gooden (R-TX), Matt Gaetz (R-FL), Ted S. Yoho, D.V.M. (R-FL), and Bryan Steil (R-WI).

Reference LinkSubmitted By: Anonymous - 8/19/2021, 10:29:51 PM

Positive. +1

Rep. Budd is a co-sponsor of H.R. 923 H.R. 923, the U.S. Virtual Currency Market and Regulatory Competitiveness Act of 2019, would require an additional report from the CFTC Chairman, in consultation with the heads of the SEC and other relevant federal agencies as he deems necessary, on the state of virtual markets and ways to promote American competitiveness. The report, to be provided within one year of H.R. 923’s enactment, would include: - a comparative study of U.S. and international regulation of virtual currency (defined in the same terms as H.R. 922); - an evaluation of the potential benefits of virtual currency and blockchain technology in the U.S. commodities market; - legislative proposals to improve federal agencies’ ability to promote U.S. competitiveness and encourage growth of adoption of virtual currencies in the commodity market; and - recommendations regarding legislative changes to enable federal agencies to refine which virtual currencies qualify as commodities, and to formulate and provide a cost-benefit analysis for a new regulatory structure for virtual currency spot markets.

Reference LinkSubmitted By: Anonymous - 8/19/2021, 9:35:56 PM

Positive. +1

U.S. Rep. Tom Emmer (R-Minn) and a bipartisan group from the House Blockchain Caucus want IRS Commissioner Charles Rettig to change the federal agency’s guidance on how it considers charitable, cryptocurrency donations of more than $5,000, according to a letter sent Thursday. The Internal Revenue Service currently requires taxpayers to have an IRS appraiser determine the value of their cryptocurrency donations. That differs from the IRS’ guidance on cryptocurrency purchases and sales, which allows taxpayers to calculate their obligations based on free market value. The Blockchain Caucus’ chairs, Emmer, Darren Soto (D-Fla.), David Schweikert (R-Ariz.) and Bill Foster (D-Ill.), and Caucus members Ted Budd (R-N.C.), Ro Khanna (D-Calif.) and Josh Gottheimer (D-N.J.) signed the letter, which asked Rettig to amend the tax code’s Form 8283, the Noncash Charitable Contributions Form, to allow fair market evaluation for crypto donations.

Reference LinkSubmitted By: Anonymous - 8/19/2021, 9:26:14 PM

Positive. +1

A group of United States congressmen has requested that Lawrence Kudlow, the director of the National Economic Council, hold a blockchain forum, in a letter published on May 24 2019. A group of seven congressmen, including Trey Hollingsworth, Darren Soto, Bill Foster, Tom Emmer, Ted Budd, Josh Gottheimer, and David Schweikert, has submitted a request to hold a forum on blockchain technology. In the request, the congressmen note the difficulty of applying purportedly out-dated legislation to emerging technologies, stating that a lack of regulatory clarity could negatively impact the development of new tech like blockchain. The lawmakers further argued that the technology could change a variety of industries in the US economy: “Blockchain technology is an example of digital innovation that has the potential to transform a myriad of industries through its ability to improve the transparency, efficiency, and security of transactions and information in the financial services, health care, insurance, trade finance, and supply chain management sectors, among others.”

Reference LinkSubmitted By: Anonymous - 8/19/2021, 8:29:57 PM

Positive. +1

Rep. Budd is a co-sponsor of the Eliminate Barriers to Innovation Act of 2021 Introduced in House (03/08/2021) Eliminate Barriers to Innovation Act of 2021 This bill requires the Securities and Exchange Commission and the Commodity Futures Trading Commission to jointly establish a working group on digital assets. The working group must (1) report on the impact of the U.S. legal and regulatory framework on the digital asset market; and (2) provide recommendations regarding digital asset market fairness and integrity, cybersecurity standards, and the reduction of fraud and manipulation.

Reference LinkSubmitted By: Anonymous - 8/19/2021, 7:56:08 PM

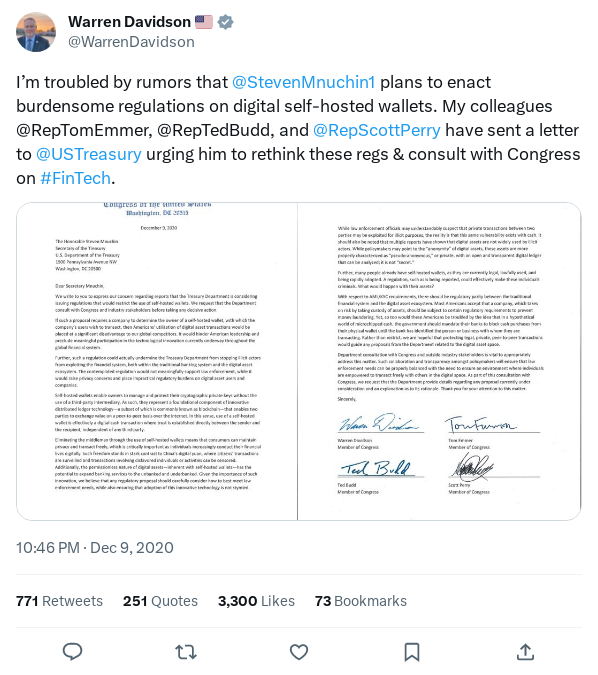

Positive. +1

"I’m troubled by rumors that @StevenMnuchin1 plans to enact burdensome regulations on digital self-hosted wallets. My colleagues @RepTomEmmer, @RepTedBudd, and @RepScottPerry have sent a letter to @USTreasury urging him to rethink these regs & consult with Congress on #FinTech."

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 8/19/2021, 7:51:05 PM

Positive. +1

According to a press release from Davidson’s office on Monday, the Token Taxonomy Act, first introduced in 2018, seeks to exempt certain cryptocurrencies and digital assets from federal securities laws. Specifically, the bill aims to amend the Securities Act of 1933 and the Securities Exchange Act of 1940 for that purpose. If successful, regulators such as the Securities and Exchange Commission would be afforded greater clarity on how best to enforce securities laws as it relates to cryptocurrency tokens. Representatives Ted Budd (R-N.C.), Darren Soto (D-Fla.), Scott Perry (R-Penn.) and Josh Gottheimer (D-N.J.) co-sponsored the bill, which is now making its third pass through the House of Representatives after last hitting a wall in 2019.

Reference LinkSubmitted By: Anonymous - 8/17/2021, 9:10:47 PM

Positive. +1

Rep. Budd is a member of the Congressional Blockchain Caucus.

Reference LinkSubmitted By: Anonymous