Elizabeth Warren

- MAMassachusetts

- Senior Senator

Elizabeth Warren (D)

MassachusettsSenior SenatorOffice:

311 Hart Senate Office Building Washington DC 20510

Memberships:

- Senate Committee on Armed Services

- Senate Committee on Banking, Housing, and Urban Affairs

- Senate Committee on Finance

- Senate Special Committee on Aging

Terms:

- 2025 to 2031 - MA Senator

- 2019 to 2025 - MA Senator

- 2013 to 2019 - MA Senator

Add An Item To Elizabeth Warren's Record

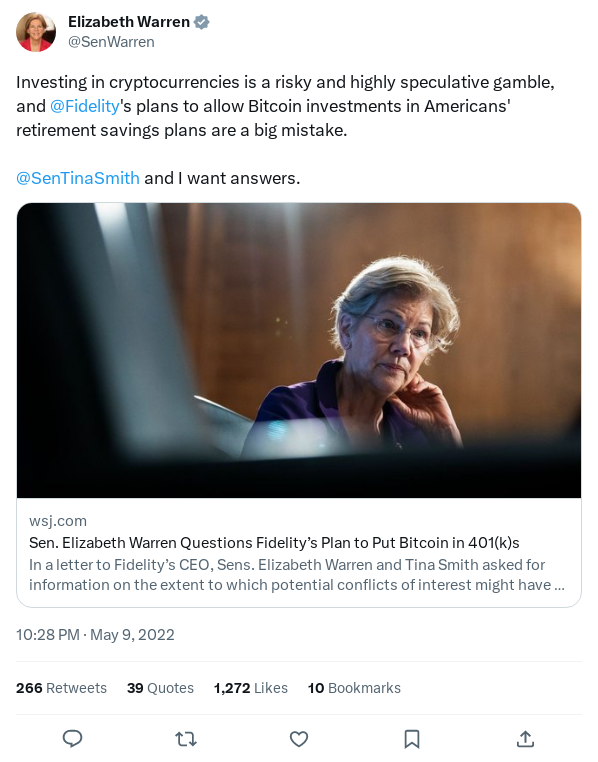

Elizabeth Warren's Record on Bitcoin, Cryptocurrencies, and Blockchain

- 6/23/2023, 4:18:42 PM

Negative. +1

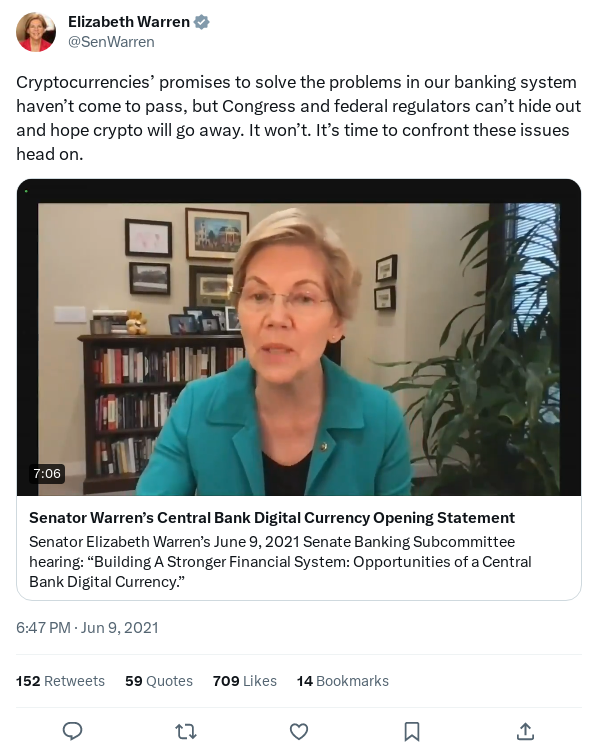

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 4:17:40 PM

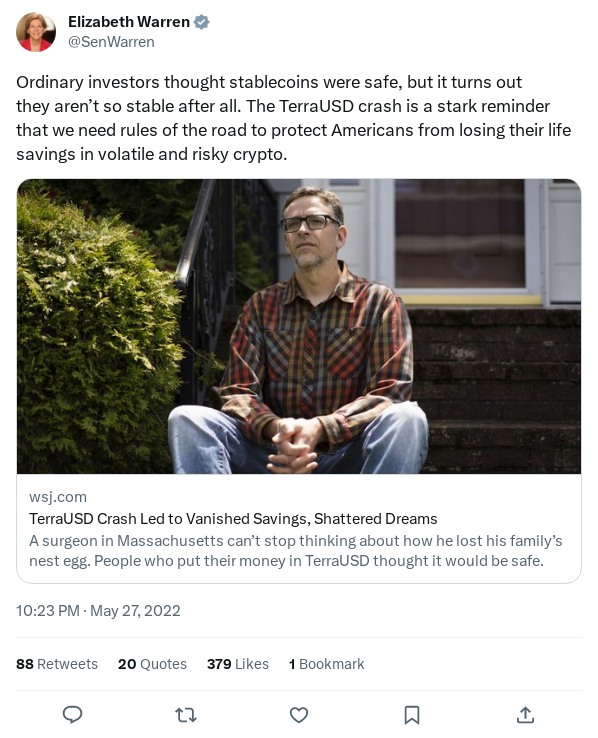

Negative. +1

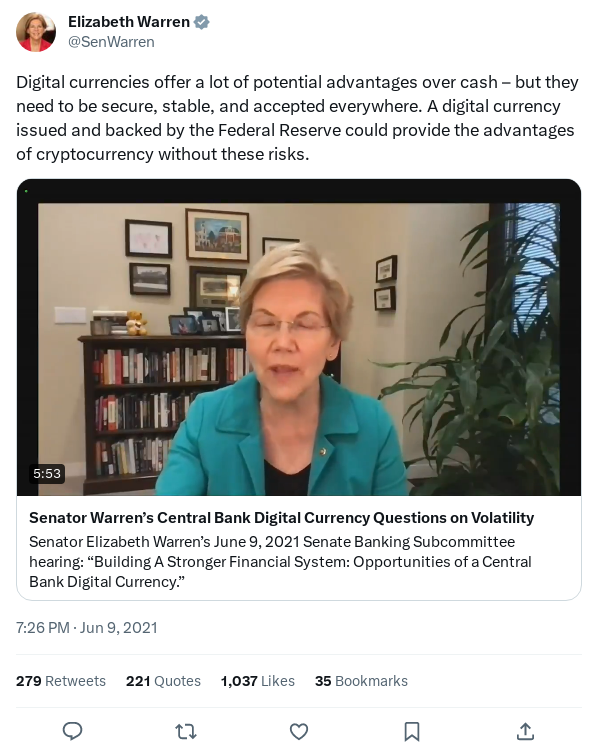

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 4:17:37 PM

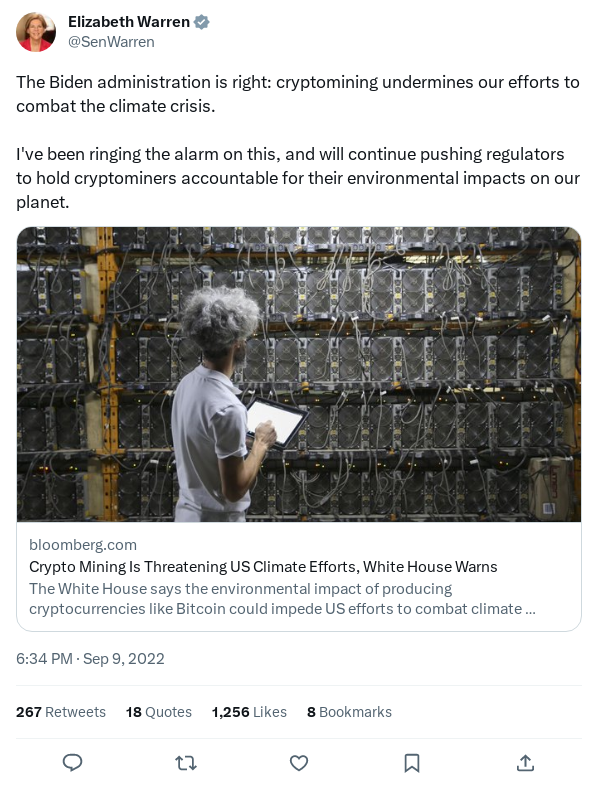

Negative. +1

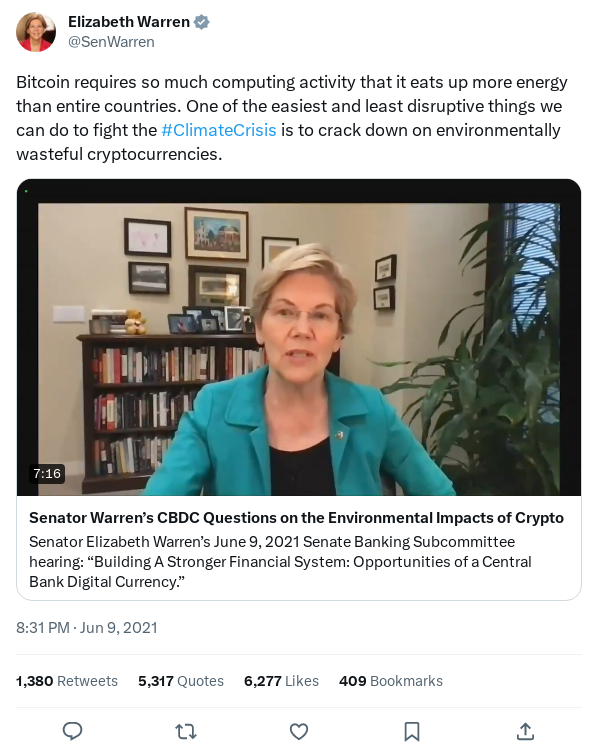

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 4:17:31 PM

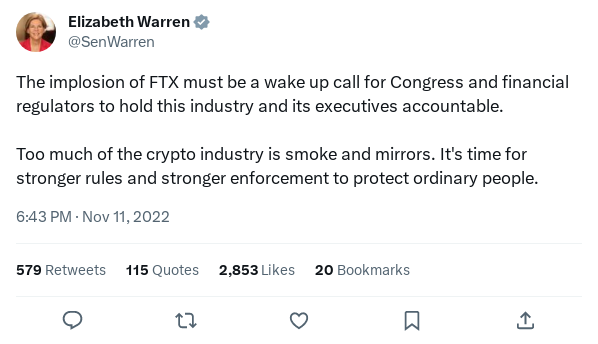

Negative. +1

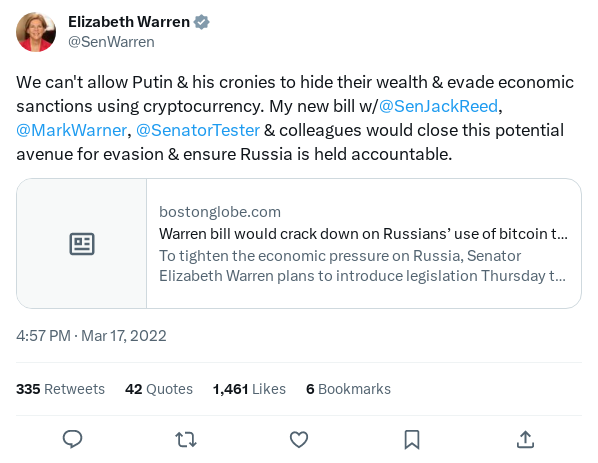

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 4:17:28 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 1:27:19 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 1:27:16 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 1:26:11 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 1:26:09 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 1:26:03 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 1:26:00 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 12:28:37 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 12:28:34 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 12:28:31 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 12:28:29 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 12:28:27 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 12:27:24 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 12:27:21 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 12:27:18 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 12:27:16 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 12:27:13 PM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 11:22:26 AM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 11:22:23 AM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 11:22:20 AM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/23/2023, 11:22:17 AM

Negative. +1

Senator Warren Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous