Ro Khanna

- CACalifornia

- District 17 Representative

Ro Khanna (D)

CaliforniaDistrict 17 RepresentativeOffice:

306 Cannon House Office Building Washington DC 20515-0517

Memberships:

- House Committee on Armed Services

- House Committee on Oversight and Government Reform

- House Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party

Terms:

- 2025 to 2027 - CA District 17 Representative

- 2023 to 2025 - CA District 17 Representative

- 2021 to 2023 - CA District 17 Representative

- 2019 to 2021 - CA District 17 Representative

- 2017 to 2019 - CA District 17 Representative

Add An Item To Ro Khanna's Record

Ro Khanna's Record on Bitcoin, Cryptocurrencies, and Blockchain

- 7/18/2025, 6:56:41 AM

Positive. +1

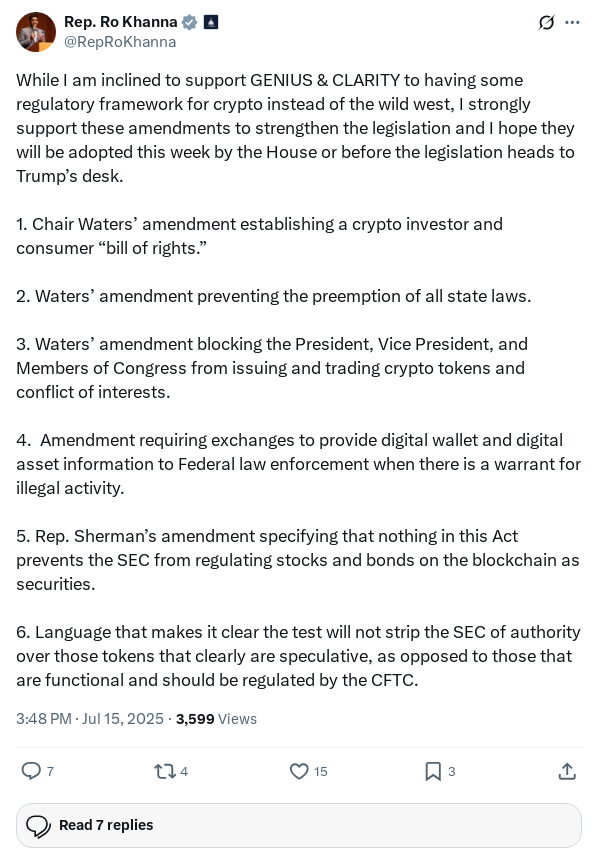

Representative Khanna Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 7/17/2025, 10:01:36 PM

Positive. +1

17-Jul-2025: Ro Khanna voted FOR H R 3633 H R 3633 Title: CLARITY Act

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 7/17/2025, 10:01:26 PM

Positive. +1

17-Jul-2025: Ro Khanna voted FOR S 1582 S 1582 Title: GENIUS Act

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 7/17/2025, 4:58:45 PM

Negative. +1

16-Jul-2025: Ro Khanna voted AGAINST H RES 580 H RES 580 Title: Providing for consideration of the bills (H.R. 4016) Department of Defense Appropriations Act, 2026; (H.R. 3633) CLARITY Act; (H.R. 1919) Anti-CBDC Surveillance State Act; and (S. 1582) GENIUS Act

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 7/17/2025, 4:51:13 PM

Negative. +1

16-Jul-2025: Ro Khanna voted AGAINST H RES 580 H RES 580 Title: Providing for consideration of the bills (H.R. 4016) Department of Defense Appropriations Act, 2026; (H.R. 3633) CLARITY Act; (H.R. 1919) Anti-CBDC Surveillance State Act; and (S. 1582) GENIUS Act

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 7/16/2025, 7:49:58 PM

Negative. +1

15-Jul-2025: Ro Khanna voted AGAINST H RES 580 H RES 580 Title: Providing for consideration of the bills (H.R. 4016) Department of Defense Appropriations Act, 2026; (H.R. 3633) CLARITY Act; (H.R. 1919) Anti-CBDC Surveillance State Act; and (S. 1582) GENIUS Act

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 7/16/2025, 7:36:52 PM

Negative. +1

15-Jul-2025: Ro Khanna voted AGAINST H RES 580 H RES 580 Title: Providing for consideration of the bills (H.R. 4016) Department of Defense Appropriations Act, 2026; (H.R. 3633) CLARITY Act; (H.R. 1919) Anti-CBDC Surveillance State Act; and (S. 1582) GENIUS Act

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 7/16/2025, 6:55:17 AM

Positive. +1

Representative Khanna Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 3/12/2025, 7:10:34 PM

Positive. +1

11-Mar-2025: Ro Khanna voted FOR H J RES 25 H J RES 25 Title: Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Internal Revenue Service relating to “Gross Proceeds Reporting by Brokers That Regularly Provide Services Effectuating Digital Asset Sales”

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 10/2/2024, 12:01:46 AM

Positive. +1

Representative Khanna Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 9/26/2024, 8:01:37 PM

Positive. +1

Representative Khanna Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 7/26/2024, 3:24:32 PM

Positive. +1

Representative Khanna Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 7/11/2024, 4:29:18 PM

Positive. +1

11-Jul-2024: Ro Khanna voted FOR H J RES 109 H J RES 109 Title: Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Securities and Exchange Commission relating to “Staff Accounting Bulletin No. 121”

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 6/10/2024, 9:08:59 PM

Positive. +1

Representative Khanna Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 5/23/2024, 2:41:13 PM

Positive. +1

22-May-2024: Ro Khanna voted FOR H R 4763 H R 4763 Title: Financial Innovation and Technology for the 21st Century Act

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 5/16/2024, 9:33:25 PM

Negative. +1

8-May-2024: Ro Khanna voted AGAINST H J RES 109 H J RES 109 Title: Providing for congressional disapproval under chapter 8 of title 5, United States Code, of the rule submitted by the Securities and Exchange Commission relating to “Staff Accounting Bulletin No. 121”

Reference LinkSubmitted By: ElectBitcoin.org Congressional Vote History - 6/24/2023, 1:02:47 AM

Positive. +1

Representative Khanna Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/24/2023, 1:01:39 AM

Positive. +1

Representative Khanna Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 6/24/2023, 1:00:32 AM

Positive. +1

Representative Khanna Tweeted or was mentioned:

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 8/29/2021, 10:46:43 PM

Positive. +1

Rep Khanna Tweets support for amending the burdensome cryptocurrency provision of the infrastructure bill: 'We absolutely need to ensure tax compliance for crypto but without picking winners and losers in the industry or ensnaring software developers and miners. We need well crafted regulation.'

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 8/29/2021, 10:43:42 PM

Positive. +1

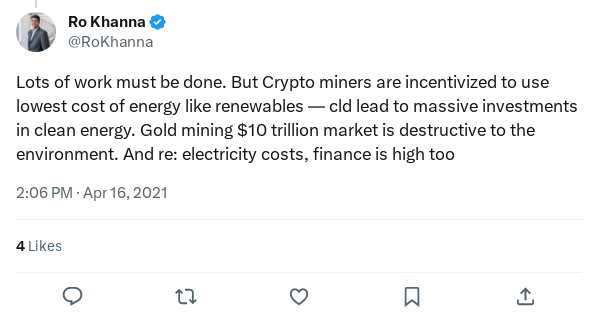

Rep Khanna chimes in on the Bitcoin mining energy debate in a twitter thread: 'Agree on energy usage needing to be solved but has to be compared with gold, finance and other stores of value. But that is a big challenge. I’m not a techno utopian but think blockchain and crypto have many uses that are here to stay.' 'Lots of work must be done. But Crypto miners are incentivized to use lowest cost of energy like renewables — cld lead to massive investments in clean energy. Gold mining $10 trillion market is destructive to the environment. And re: electricity costs, finance is high too' n n'You can be for M4A, $15, free public college, Green New Deal, stronger unions, Pro Act, ending fossil fuel subsidies, ending endless wars, defense cuts and still believe blockchain and tech power to do good properly regulated. Progressives don’t have to reject tech but shape it.'

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 8/29/2021, 10:34:22 PM

Positive. +1

U.S. Representatives Tom Emmer (R-Minn.), Darren Soto (D-Fla.) and Ro Khanna (D-Calif) have reintroduced a bill to define how federal regulators should treat cryptocurrencies. If signed into law, the Securities Clarity Act would treat digital assets as commodities, not securities, meaning startups would be free to sell and trade cryptocurrencies without having to worry about registering them as securities with the Securities Exchange Commission (SEC). Emmer, the bill's lead sponsor and a member of the Congressional Blockchain Caucus, said "regulatory uncertainty" has been harmful to the crypto industry's growth within the U.S. "There has been an unreasonable approach by regulators as to how federal securities laws should be applied to transactions involving the sale of blockchain-based tokens, and this lack of clarity is hurting American innovation,” Emmer said. This bill has been endorsed by the Chamber of Digital Commerce, the Blockchain Association and Coin Center.

Reference LinkSubmitted By: Anonymous - 8/29/2021, 10:28:32 PM

Positive. +1

Rep Khanna Tweets: "#Bitcoin uses energy like cars, gold, & finance. Valuable things require energy. Mining must be greener. The BTC #LightningNetwork reduces consumption. We need BTC owners like @jack @elonmusk @Tesla to continue to drive clean energy innovation."

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 8/29/2021, 10:27:46 PM

Positive. +1

Rep Khanna Tweets: 'Bitcoin like digital gold cannot be devalued & it’s decentralization promotes transnational exchange & provides a check against economic mismanagement. Lets nurture it but protect consumers, prevent abuse, & invest in less carbon intensive mining. That should happen in America.'

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous - 8/29/2021, 10:26:48 PM

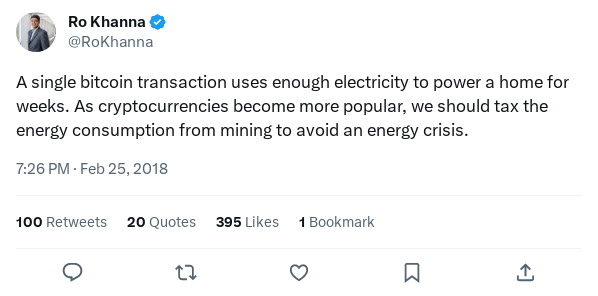

Negative. +1

Rep Khanna Tweeted: "A single bitcoin transaction uses enough electricity to power a home for weeks. As cryptocurrencies become more popular, we should tax the energy consumption from mining to avoid an energy crisis."

Click for Tweet Screenshot In Case of Deletion or Edits

Reference LinkSubmitted By: Anonymous

Reference LinkSubmitted By: Anonymous